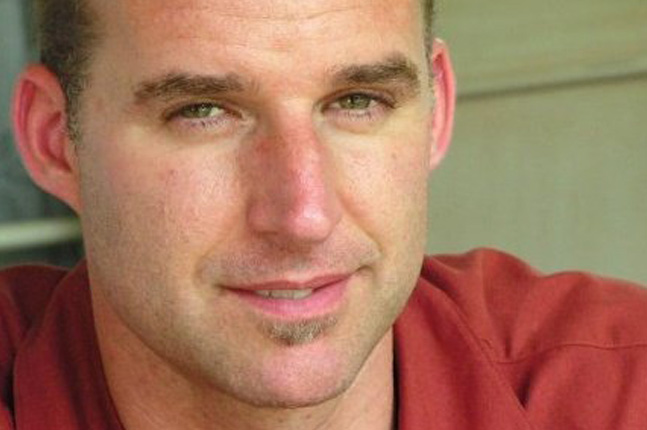

When Kent Goldman left First Round Capital earlier this year, he did so with plans to start his own investment firm. Now he’s ready to talk about the firm, which is called Upside Partnership and just closed on $30 million to invest in seed-stage startups.

Goldman started as a principal at First Round in 2008 before moving up to partner in 2012. There he made about 17 investments over that time. Notable companies included HotelTonight, Airware, MemSQL, Path, Liftopia, Threadflip, Cabana (acquired by Twitter), and HotPotato (acquired by Facebook), among others. Before that, he held corp dev and strategy roles at Yahoo.

With that background he felt the time was right to strike out on his own with Upside, which he calls a “pure seed-stage fund.” Its focus will be on making bets on startups at the earliest stages. That, of course, plays to Goldman’s strengths.

First Round, where he spent the last six years, prides itself on being first money in to some of the biggest startups out there. Unlike some other investors who have recently started seed investing, Goldman’s been in the trenches for years, and he expects that experience to be one of his key differentiators.

“I want to be in a position where I can be one of the most helpful investors and advisers to the business,” he told me in an interview Wednesday.

But Upside isn’t just about Goldman. It’s also about a community of founders that he hopes to build, all of which will want to help each other out. That’s because Upside isn’t just a firm for him to invest capital in startups; it’s a “partnership” where founders of the portfolio companies he invests in also have a stake in the overall success of the fund. Founders, he believes, get their best advice and guidance not from the people who fund them, but from other founders in their immediate network. As a result, Upside is designed to encourage startups to help one another out.

To do so, the firm has allocated a certain percentage of Upside’s carry — that is, the percentage of profits that get passed on to partners in a firm — to be set aside for founders. The idea is that founders who are backed by Upside will be incentivized to ensure the success of the broader portfolio.

So how much carry do they get? Goldman won’t say exactly, but he claims the percentage is in the double digits.

Goldman expects to do about eight early-stage investments a year, with an average check size of about $300,000. As with most funds of its size and stage, Upside will allocate more than half of its $30 million to do follow-on investing in companies when they hit later rounds.

As a result, Goldman says he can work with startups around ownership and check size without having to worry about how either will affect his model. That comes in contrast to some larger firms, which require a certain investment size or ownership percentage in early deals to justify an investment.

“I believe very strongly in small funds,” Goldman says. “There are too many venture investors solving problems for their own business model rather than the needs of the founders.”

Upside won’t look for companies in specific verticals; Goldman says he doesn’t want to limit his investment opportunities by doing so. The firm will, however, seek out purpose-driven founders, the kinds of folks who are looking to solve a specific problem and have the unique background to do so.

For now, Upside is just Goldman.

“I didn’t set out to be a single [general partner],” he said. But he wanted to get the fund and business up and running as quick as possible. Now that it’s done, he might bring other partners on board. In the meantime, Upside’s portfolio companies will support one another. And with a portion of the carry, they’ll have good reason to do so.